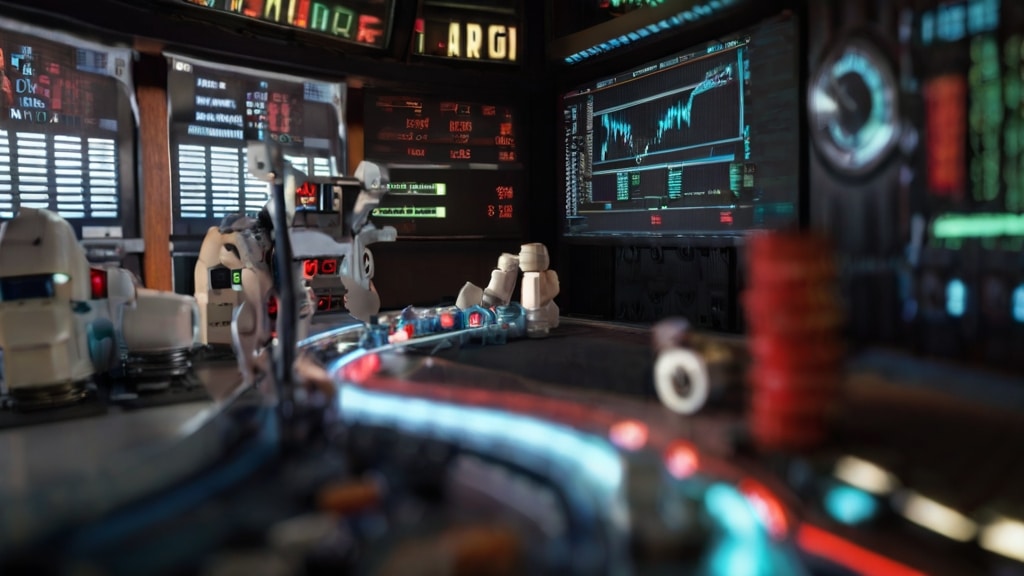

As we welcome the advances of 2024, the fintech horizon is witnessing an unprecedented emphasis on automated trading, powered by sophisticated crypto algorithms and dynamic trading strategies. With the cryptocurrency market trends evolving at lightning speed, traders are increasingly turning to innovative tools such as trading bots to stay ahead of the curve. In an era where efficiency and agility are not merely desirable but essential attributes for success, the integration of these tools into one’s trading arsenal is becoming the norm. The most effective trading bots of today, fueled by the cutting-edge Tokenrobotic technologies, exemplify the symbiosis of human trading intuition and the relentless precision of automated systems.

Key Takeaways

- Crypto trading bots augment trading strategies with advanced automation.

- Tokenrobotic technologies drive innovations in the crypto trading bot landscape.

- 2024 is pivotal for the implementation of crypto algorithms in market trading.

- Automated trading bots are essential for capitalizing on 24/7 cryptocurrency market trends.

- Choosing the right trading bot is crucial for executing sophisticated trading strategies.

- User adaptability to automated tools is key to remaining competitive in the evolving crypto market.

Understanding Crypto Trading Bots

In the realm of automated crypto trading, the innovation that stands out is the crypto trading bot. This sophisticated market analysis software serves as a comprehensive tool enabling both seasoned and novice traders to optimize their trading expeditions in the volatile digital asset marketplace. The efficiency of these bots is driven by their capacity to employ complex crypto trading strategies, rendering them invaluable in the pursuit of capitalizing on market movements.

What is a Crypto Trading Bot?

A crypto trading bot is a software program designed to interact with financial exchanges directly, placing buy or sell orders on behalf of the trader. These bots become the steadfast allies of traders, implementing trades at velocities that match the pace of the market, day or night. By leveraging various technical indicators, these bots enact predetermined trading strategies, delivering on the promise of tokenrobotic precision and consistency in the execution of trades.

The Core Functions of Trading Bots

The essence of a trading bot’s utility lies in its multifaceted core functions. Firstly, it analyzes market data, scrutinizing volumes, prices, and orders. Secondly, it predicts and reacts to market trends, adapting by making split-second decisions based on complex algorithms. It’s worth noting that these bots are not immune to market anomalies but are equipped to handle the planned strategies against the unpredictability of market behavior.

Types of Crypto Trading Bots

Diverse forms of trading bots dominate the financial ecosystem, each optimized for unique crypto trading strategies. To elucidate, we shall consider a comparison of the common varieties:

| Type of Bot | Core Function | Use Case |

|---|---|---|

| Arbitrage Bots | Exploiting price differentials across exchanges. | Best for traders who are looking to capitalize on cross-exchange price inefficiencies. |

| Market Making Bots | Creating liquidity by continually placing buy and sell limit orders. | Ideal for exchanges or individuals aiming to benefit from the spread between the buy and sell price. |

| Technical Analysis Bots | Making trades based on technical indicators and chart patterns. | Suitable for those who trade based on the analysis of technical data rather than fundamental factors. |

Each bot type serves a specific purpose within the trading strategy, integrating seamlessly with various platforms and amplifying the efficiency of the trading process. As we continue to explore the promising field of automated crypto trading, it becomes evident that an astute understanding of these bots is imperative for anyone looking to tread the digital asset markets with tokenrobotic finesse and acumen.

Advantages of Using Crypto Trading Bots

The integration of crypto trading bots into cryptocurrency trading strategies provides an array of benefits that can significantly enhance trade performance and efficiency. These tools are not just innovative; they represent a new frontier in high-frequency trading, where efficiency and the ability to operate 24/7 are consequential to success.

- Operational Efficiency: By executing trades at speeds unfathomable to the human trader, crypto trading bots empower investors to glean the benefits of high-frequency trading, executing numerous trades simultaneously across various platforms.

- 24/7 Trading: Unlike traditional markets, the crypto market never sleeps. Trading bots maintain a relentless watch over market movements, ensuring no opportunity is missed, regardless of the hour.

- Emotional Discipline: Emotion is often the trader’s greatest nemesis. Crypto trading bots operate on pure logic and predefined strategies, preserving emotional discipline and mitigating impulsive decisions that might lead to losses.

- Consistency: One core element that sets trading bots apart is their ability to consistently execute trades in alignment with the strategy set by the trader, fostering a disciplined and methodical approach to trading.

Investors who incorporate the tokenrobotic prowess of trading bots into their arsenal can reap significant dividends from a market that is simultaneously volatile and ripe with potential. Below, we delineate the key advantages of deploying these automated systems in a comparative framework:

| Advantage | Description | Impact on Trading |

|---|---|---|

| Market Efficiency Utilization | Capitalizing on market movements through rapid, algorithm-driven decision-making. | Enhances the ability to make profitable trades based on real-time market data. |

| Round-the-Clock Trading | Operates constantly, unfazed by human limitations such as the need for sleep or breaks. | Ensures no profitable opportunity is overlooked, even during off-peak hours. |

| Emotionless Execution | Algorithms make decisions based on data, not emotion, reducing the risk of erratic trades. | Leads to a more stable and predictable trading strategy deployment. |

| High-Speed Transactions | Executes orders at a fraction of the time it takes humans to process the same information. | Allows traders to seize fleeting market opportunities before they disappear. |

As the market continues to evolve with the advancement of tokenrobotic solutions, the quintessential role of crypto trading bots becomes more evident. They are transforming the landscape of digital asset trading through a combination of relentless efficiency, availability, and emotional discipline, setting the stage for new trading paradigms in the high-stakes environment of cryptocurrencies.

Key Features to Look for in a Trading Bot

When venturing into the world of automated trading, the selection of a trading bot is a decision that requires careful consideration of several key factors. Identifying a tool that provides an edge in the fast-paced crypto markets is crucial for any trader’s success. Three fundamental features to prioritize when evaluating a trading bot are its reliability and uptime, user-friendly interface, and robust security measures. These cornerstone attributes are critical to ensuring that your bot is not only a powerful trading ally but also a secure and dependable tool that aligns with your trading strategy and goals.

Reliability and Uptime

Software dependability is paramount in the realm of automated trading. Traders need to have unwavering confidence in their bot’s ability to perform consistently without interruptions. A trading bot that boasts high uptime guarantees that trading strategies are unimpeded by unexpected downtime, which could be costly in a market that operates 24/7. Reliable software ensures that your trades are executed without delay, capitalizing on every calculated opportunity.

User-Friendly Interface

An intuitive design is essential for a trader to effectively navigate and utilize the full spectrum of a trading bot’s offerings. Navigating complex trading strategies is daunting enough without the added burden of a convoluted interface. The right trading bot has a design that enables traders to manage their operations with ease and precision, subsequently reducing the scope for errors and enhancing the overall trading experience.

Security Measures

In the digital age, encryption protocols and comprehensive risk management tools are non-negotiable aspects of a secure trading bot. These security features protect traders’ assets and personal information from cyber threats. A sophisticated bot includes the latest in security technology, and the backing of tokenrobotic advances to provide users with peace of mind that their investments are secure and their data is private.

Setting Up Your First Crypto Trading Bot

Embarking on the journey of automated trading begins with the foundational step of setting up your first crypto trading bot. This initial foray into algorithmic trading can be both exhilarating and daunting, yet with the proper guidance through the configuration, API integration, and customization process, you are on your way to harnessing the tokenrobotic efficiency that defines modern trading.

The setting-up process involves a series of actions designed to ensure your bot’s performance is finely tuned to your individual trading parameters. Below is an outline of the necessary steps that will guide you through the configuration of your crypto trading bot, ensuring it is primed to execute trades in alignment with your strategic ambitions.

- Choosing the Right Platform: Begin by selecting a reputable trading bot platform that accommodates your experience level and offers the tokenrobotic features you require.

- Registering and Verifying Your Account: Create an account with your chosen platform and complete any verification processes to ensure security and compliance.

- API Integration: Connect the bot to your preferred exchanges by setting up APIs, thus enabling two-way communication between the bot and the exchange.

- Configuration of Trading Parameters: Adjust the settings within your bot to define parameters such as asset types, investment amounts, stop losses, and take profits.

- Customization for Strategy Alignment: Tailor the trading bot’s strategies in accordance with your risk tolerance and investment goals. This might include specifying technical indicators or defining trade frequencies.

- Backtesting: Run simulations using historical data to evaluate the effectiveness of your bot’s strategy before going live.

- Going Live: With backtesting complete and confidence in place, activate the bot to begin live trading, while ensuring monitoring mechanisms are operational.

Moreover, Below is a table highlighting the relation between the critical steps and their respective details in configuring your crypto trading bot:

| Setup Step | Detail | Purpose |

|---|---|---|

| Platform Selection | Choosing a bot provider that aligns with your trading needs. | Serves as the foundation for future trading and strategy development. |

| API Setup | Secure integration with exchange platforms. | Allows for real-time data exchange and trade execution. |

| Parameter Settings | Defining trade size, risk levels, and other variables. | Customizes the bot operation to fit personal trading style and risk profile. |

| Strategy Customization | Implementing technical indicators and rules. | Aligns the bot’s decisions with targeted trading strategies. |

| Simulations and Testing | Backtesting strategies with historical market data. | Validates the strategy’s potential and prepares for actual market conditions. |

| Monitoring and Adjustment | Overseeing bot activity and adjusting parameters as needed. | Ensures ongoing optimization and responsiveness to market changes. |

With your trading bot properly configured and its parameters set to align with your specific trading goals, you stand at the precipice of a new era of trading. This foray into tokenrobotic trading is not just about setting and forgetting but continuously refining and optimizing to adapt to the ever-evolving market conditions.

Evaluating Bot Performance: Metrics to Consider

When you deploy a trading bot into the volatile world of cryptocurrency, assessing its impact on your investment strategy is critical. Understanding the profit analysis, trade frequency, success rate, and broader performance metrics are pivotal in evaluating the effectiveness of your trading operations. This assessment is crucial as it helps in fine-tuning your bot’s settings and strategies, ensuring optimal performance that aligns with your financial objectives.

A comprehensive analysis of these metrics will reveal the strengths and weaknesses in your bot’s functionality, allowing for informed decisions to be made. Below, we delve into the key metrics that are instrumental in measuring the performance of your tokenrobotic trading bot.

| Performance Metric | Description | Relevance to Trading Success |

|---|---|---|

| Profitability | Total financial gain after accounting for expenses. | Indicates the overall financial success of the bot. |

| Trade Frequency | Number of trades executed over a specific period. | Reflects the bot’s level of activity and market engagement. |

| Success Rate | Percentage of trades that are profitable. | Shows the bot’s efficiency in executing winning strategies. |

| Volatility Adaption | Bot’s ability to adjust to market fluctuations. | Measures flexibility and responsiveness to volatile market conditions. |

| Performance Benchmarking | Comparison of bot’s performance against market indices or other bots. | Provides a relative measure of strategy effectiveness. |

Understanding these metrics provides a window into how well your trading bot adjusts to market conditions and achieves its primary goal: profitability. Being proactive in analyzing these metrics can significantly heighten your trading edge. Through strategic adjustments and ongoing monitoring, traders can tailor their tokenrobotic partners to better navigate the tumultuous seas of the crypto market, ensuring a robust profit analysis, consistent trade frequency, and an admirable success rate.

Risks Associated with Crypto Trading Bots

While crypto trading bots offer a myriad of benefits such as enhanced trading speed and efficiency, their use is not devoid of risk. Traders must be cognizant of potential downsides, from the impact of market volatility to technical mishaps that could affect their investment outcomes. Being aware of the risks and implementing robust risk management strategies are essential for leveraging the advantages of tokenrobotic automation while mitigating possible negatives.

Understanding Market Risks

The cryptocurrency market is characterized by its high volatility, with prices that can swing dramatically within very short periods. Traders who implement bots must recognize that algorithms, although highly sophisticated, might not always predict or cope with sudden market shifts or black swan events. This volatility underscores the importance of continuous oversight and the readiness to adapt trading strategies as market conditions change.

Operational Risks and Bot Malfunctions

Software glitches are an inherent risk in any form of digital technology, and trading bots are no exception. Bot malfunctions could range from minor bugs affecting operational efficiencies to significant defects that result in misplaced trades or missed opportunities. Ensuring that trading bots are regularly updated and maintained is critical to minimize the risk of software glitches disrupting trading activities.

Security and Privacy Concerns

In an era where hacker vulnerabilities are a constant threat, the security and privacy of trading bots require special attention. A compromised bot can lead to unauthorized access to trading accounts and funds. Traders must prioritize the security features of their bots, including encryption protocols, two-factor authentication, and other risk management tools that provide a safeguard against cyber threats and protect sensitive data.

It is evident that while trading bots can be potent allies in the digital trading domain, their use is accompanied by risks that require vigilant management. By understanding the complexities of market volatility, operational reliability, and cybersecurity, traders can navigate these risks prudently, using tokenrobotic technology to their advantage while remaining alert to potential pitfalls.

How to Customize and Optimize Your Trading Bot

The journey to mastering the art of cryptocurrency trading is incomplete without harnessing the capabilities of a well-tuned trading bot. Customizing and optimizing your trading bot by employing strategy adaptation, historical data analysis, and algorithm optimization is essential in achieving optimal performance. Specifically, adjusting your bot’s parameters to seize real-time market opportunities demands a deep understanding of the tokenrobotic ecosystem, where precision and adaptability dictate success.

Strategy Customization Techniques

To begin customizing your trading bot, start with a clear understanding of your investment goals and risk tolerance. Tailoring its functions to serve your unique approach can include modifying algorithm parameters or incorporating specific technical indicators. The customization process demands a methodical approach to strategy adaptation, ensuring that each aspect of the bot’s performance is synchronized with your trading philosophy.

- Defining Risk Parameters: Adjusting stop-loss and take-profit settings to align with your risk strategy.

- Selecting Indicators: Choosing from a suite of technical indicators that reflect past market performance and future predictions.

- Frequency Tuning: Determining the trading frequency that balances market reactivity with a prudent approach to asset exposure.

Making Use of Backtesting Tools

Backtesting is a cornerstone of historical data analysis, enabling traders to assess the viability of a strategy by simulating its performance against past market behavior. This technique allows for the refinement of strategies and the anticipation of how they might perform under similar market conditions, significantly reducing the element of surprise upon implementation.

- Historical Data Scrutiny: Analyze past market trends to evaluate how your bot would have performed.

- Strategy Refinement: Tweak your trading strategies based on backtesting results to optimize future performance.

- Performance Analytics: Use backtesting metrics to forecast potential return on investment and risk exposure.

Adjusting Bots to Market Conditions

Real-time market adjustments are crucial for staying competitive in the fast-paced world of crypto trading. Algorithm optimization enables your trading bot to act swiftly and decisively, adapting to volatile market conditions and capitalizing on emerging opportunities. Continuous algorithmic refinements require vigilance and a proactive stance, ensuring that your bot evolves in tandem with the shifting landscape of the crypto economy.

| Bot Adjustment | Action | Market Response |

|---|---|---|

| Volatility Response | Increase sensitivity to price fluctuations. | Enhances the bot’s ability to react to sudden market shifts. |

| Trend Tracking | Integrate trend analysis for proactive trading. | Positions the bot to ride the momentum of market trends. |

| Order Frequency Modification | Adjust the speed and number of orders placed. | Aligns trading activity with market liquidity and price movements. |

| Strategy Diversification | Apply multiple strategies to spread risk. | Reduces dependency on a single market condition for profitability. |

By factoring in strategy adaptation and leveraging tokenrobotic efficiency, traders are empowered to customize trading bots that not only thrive on historical knowledge but are also engineered for agility in responding to real-time market conditions.

The Future of Automated Trading: Predictions for 2024

As we propel towards 2024, the collective whisper among fintech enthusiasts crescendos into a clear prediction: automated trading is on the cusp of remarkable transformation. At the heart of this metamorphosis are AI advancements that promise to redefine the capabilities of crypto trading bots. Analysts foresee a landscape where machine learning algorithms are ubiquitous, enabling these bots to conduct trades with unprecedented sophistication and efficacy.

The evolution of predictive analytics is particularly noteworthy. Gone are the days of mere trend analyses; the new dawn brings forth tokenrobotic systems adept in prognosticating market movements—meticulously calculating the probable outcomes before they manifest. The prowess of these futuristic trading bots lies not merely in their capacity to analyze historical data but in their aptitude for adapting strategies in real time to an ever-changing market.

This isn’t wishful forecasting; it’s a vision grounded in the rapid technological progression we’ve witnessed in recent years. The intersection of trading and technology has been a hotbed for innovation, but with market adaptability being crucial to success, the next leap forward hinges on dynamic systems that can learn, interpret, and act instantaneously.

| 2024 Prediction | Impact on Automated Trading | Benefit for Traders |

|---|---|---|

| Advanced AI Application | Seamless integration of deeper learning, reasoning and decision making in bots | More intuitive trading experiences with higher precision in trades |

| Enhanced Predictive Analytics | Ability to gauge future market conditions based on complex patterns and datasets | Improved risk management through more accurate future market forecasts |

| Adaptive Machine Learning | Bots that self-optimize in response to market fluctuations in real time | Increased profitability and lower downtimes due to agile response capabilities |

| Tokenrobotic System Integration | Greater fusion of automated trading bots with blockchain ecosystems | Enhanced security and transparent operations aligned with decentralized principles |

Within this tapestry of potential, the traders themselves play a crucial role. The agile trader of 2024 no longer spends hours analyzing graphs and charts but instead strategizes over the optimal conditions to let their tokenrobotic colleagues plow the digital fields. Trust in technology becomes paramount, as does the understanding of its workings. The nexus of machine learning algorithms and AI advancements will not only transform the trading bots but also the traders who wield them.

Indeed, the horizon is luminous for those prepared to embrace the tokenrobotic tide, as predictive analytics intertwine with human insight to sculpt a new epoch of market adaptability. The traders who pivot and morph with the evolving landscape—those who harness the symphony of AI and machine learning—will define the future of automated trading.

How to Choose the Right Trading Bot

Selecting the ideal trading bot is akin to selecting a reliable financial companion. It should align with your trading goals and operate within the parameters of risk you are willing to take. Picking a bot that complements your investment style is critical, and this task obligates you to diligently consider platform comparison, user testimonials, software credibility, and meticulous selection criteria. The integration of tokenrobotic technology has added a layer of sophistication to the trading bot spectrum, making choice an even more strategic endeavor.

Comparing Top Bot Providers

Embarking on a platform comparison will unfold the landscape of features, efficiencies, and specialties various trading bots provide. It’s not just about the technical capabilities but also about the compatibility of the bot with your trading platform of choice. Leading providers distinguish themselves not only by the sophistication of their software but also by their commitment to ongoing innovation and user-centered enhancements.

| Bot Provider | Supported Exchanges | Unique Features | Price Range |

|---|---|---|---|

| Provider A | 10+ Major Exchanges | Advanced AI Analysis Tools | $99 – $299 / month |

| Provider B | 5+ Major Exchanges | Custom Strategy Builder | $50 – $200 / month |

| Provider C | 15+ Major Exchanges | 24/7 Customer Support | $150 – $400 / month |

Community Feedback and Reviews

The credibility of software is often authenticated by user testimonials. Reviews from the community provide invaluable insights and can greatly influence the selection process. It’s the real-world usage scenarios and experiences shared by fellow traders that highlight a bot’s ability to deliver on its promises. Hearing about the bot’s performance through the grapevine of the trading community drastically reduces the uncertainty surrounding a particular bot’s efficacy.

“Crypto Bot X not only simplified my trading strategy but also introduced me to features I didn’t know I needed. The time I’ve saved and the precision of the trades has made this an invaluable tool for my portfolio.” – Jamie Smith, Seasoned Trader

Additional Considerations for Selection

While user testimonials and provider features play pivotal roles in the selection process, additional criteria may further steer your decision toward the right choice. These include the bot’s ability to provide timely updates, its responsiveness to market volatility, the duration and quality of customer support provided, and not least, the cost-benefit analysis. The optimal bot doesn’t just align with your current needs but grows with you, adapting to market fluctuations with tokenrobotic agility, ensuring a prosperous and enduring trading journey.

- Customer Support Quality: Access to reliable support can be a deciding factor, particularly during critical trading windows.

- Cost-benefit Analysis: Weighing the expense against potential returns to ensure financial viability in the long run.

- Software Updates: Regular updates are indicative of a commitment to maintaining a cutting-edge platform.

- Compatibility with Investment Goals: The trading bot should be flexible enough to align with your evolving objectives.

Conclusion

As we conclude this examination of the dynamic world of cryptocurrency trading bots and their burgeoning role in 2024, the crucial takeaways can be distilled into two primary facets: the strategic investment in the right trading bot and the unceasing education in trading for the modern trader. Delving into this dichotomy offers up a comprehensive lens into the actualization of trading success within this tokenrobotic ecosystem.

Maximizing Returns with the Right Bot Choice

Making an informed decision on the selection of a trading bot is more than a matter of convenience; it’s a cornerstone of any strategic investment. Performance analysis is key, empowering traders to utilize tokenrobotic precision to exploit market opportunities. However, the sheer array of options available necessitates a discerning eye, capable of evaluating each bot’s features against personal trading strategies and goals. Ultimately, the bot that provides consistency and aligns with your risk appetite will be your stalwart ally on the path to enhanced returns.

The Importance of Continuous Learning in Crypto Trading

Yet, even with the most advanced tokenrobotic companions, the education in trading remains an indispensable pillar for the forward-thinking trader. The crypto markets are fickle, their ebbs and flows unpredictable; keeping abreast of these changes, therefore, requires a commitment to continuous learning. By blending astute performance analysis with the dexterity of automated tools, traders craft informed decisions that capitalize on the volatility of cryptocurrency. It’s within this synergy of machine intelligence and human insight that the future of trading not only survives but thrives.

In summary, the landscape of crypto trading in 2024 is one of advanced tools and sophisticated strategies. The judicious choice of a crypto trading bot combined with an ongoing dedication to market education sets the stage for achieving strategic investment goals. As traders navigate this intricate domain, it is the harmony of tokenrobotic efficiency and informed human decision-making that will herald new pinnacles of trading achievement.

FAQ

What are crypto trading bots and why are they important?

Crypto trading bots are automated software programs that execute trades on behalf of individuals within the cryptocurrency market. They are important because they can operate 24/7, executing trades based on predefined parameters and analysis, making them valuable for their efficiency and ability to respond quickly to market trends and opportunities.

What functions do trading bots serve in the cryptocurrency market?

Trading bots primarily serve to automate the trading process, execute strategies based on technical indicators, provide market analysis, and assist users in managing their cryptocurrency portfolios more effectively. They can perform a range of tasks, from simple order execution to complex trading strategies involving multiple cryptocurrencies.

How do various crypto trading bots differ from one another?

Different crypto trading bots may vary based on their intended purpose such as arbitrage, market making, or implementing technical analysis strategies. Additionally, they differ in terms of complexity, customization options, supported exchanges, and the range of parameters that can be set for trading decisions.

What are the key advantages of using a crypto trading bot?

The key advantages include the ability to trade efficiently and without emotional interference, 24/7 operation facilitating trades at any time, and the capacity for high-frequency trading which can capitalize on small price movements for potential profits.

What essential features should I look for when selecting a trading bot?

When selecting a trading bot, it’s important to consider features such as reliability and uptime to ensure consistent trading, a user-friendly interface for ease of use, and robust security measures to protect your investments and personal information.

How do I set up my first crypto trading bot?

Setting up your first crypto trading bot involves choosing a reputable platform, integrating with your cryptocurrency exchange via APIs, and configuring the bot’s settings according to your trading goals and risk tolerance.

What metrics should I consider when evaluating my trading bot’s performance?

Consider evaluating your trading bot’s performance by analyzing profit margins, trade frequency, success rate of executed strategies, and overall alignment with your investment goals. Regularly reviewing these metrics can help you to optimize your bot’s performance over time.

What risks are associated with crypto trading bots?

Some risks include market volatility, operational risks such as bot malfunctions or software glitches, along with security concerns such as vulnerabilities to hackers and maintaining data privacy.

How can I customize and optimize my trading bot?

You can customize and optimize your trading bot by adjusting its strategy settings, utilizing backtesting tools to simulate strategies with historical data, and adapting the bot’s algorithms in response to real-time market conditions.

What developments can we expect in the future of automated trading for cryptocurrencies?

Future developments in automated crypto trading are likely to be driven by advancements in AI and machine learning algorithms, leading to more sophisticated predictive analytics and improved adaptability to market conditions.

How can I choose the right trading bot for my needs?

Choosing the right trading bot involves comparing top bot providers, considering community feedback and reviews, and evaluating additional selection criteria like feature sets, cost, customer support, and alignment with your trading objectives.

What additional keywords are relevant to these FAQs?

Additional keywords relevant to this topic include automated trading, crypto algorithms, trading strategies, cryptocurrency market trends, automated crypto trading, market analysis software, technical indicators, efficiency, software dependability, intuitive design, encryption protocols, configuration, API integration, profit analysis, volatility, software glitches, strategy adaptation, historical data analysis, AI advancements, platform comparison, strategic investment, and education